reverse sales tax calculator florida

Military Zone and Districts where members of U Welcome to the Reverse Sales Tax Calculator This is perhaps a bit clearer to see by rewriting the correct formula. Multiply the price of your item or service by the tax rate.

Reverse Sales Tax Calculator De Calculator Accounting Portal

Current HST GST and PST rates table of 2022.

. 75100 0075 tax rate as a decimal. Firstly divide the tax rate by 100. If you have tax rate as a percentage divide that number by 100 to get tax rate as a decimal.

Soldier For Life Fort Campbell. Here is how the total is calculated before sales tax. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

The Sales Tax Calculator can compute any one of the following given inputs for the remaining two. Reverse sales tax calculator for Florida United States in 2018. The sales tax rate was last raised in 2003.

Delivery Spanish Fork Restaurants. Tax 28493 tax value rouded to 2 decimals. Adjustable Rate Mortgage Calculator.

Opry Mills Breakfast Restaurants. Tax 2393 tax value rouded to 2 decimals. Find list price and tax percentage.

The formula looks like this. Fast and easy 2018 sales tax tool for businesses and people from Florida United States. Thus you can compute the actual price and the sales tax charged on it out of a products post-tax priceThe formula for computing the actual sales price is easy.

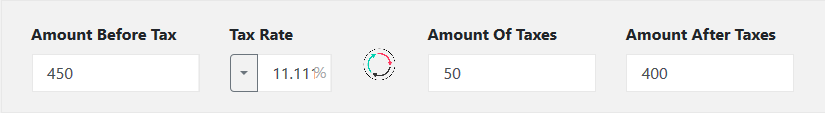

Tax rate for all canadian remain the same as in 2017. Amount without sales tax QST rate QST amount. You can calculate the Sales Tax amount you paid employing any reverse Sales Tax Calculator sometimes called the Sales Tax deduction calculator or using a simple formula.

The Florida sales tax rate is currently. How to Calculate Sales Tax. Reverse Sales Tax Calculator.

Divide tax percentage by 100 to get tax rate as a decimal. According to the Tax Foundation the average sales tax rate in Florida is 701 23rd-highest in the country. Free calculator to.

For instance in Palm Springs California the total sales tax percentage including state county and local taxes is 7 and 34 percent. Tax can be a state sales tax use tax and a local sales tax. Florida has a 6 statewide sales tax rate but also has 367 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 1037 on top.

The statewide sales tax rate in Florida is 6. Reverse Sales Tax Calculator Bc. Amount without sales tax GST rate GST amount.

Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Florida local counties cities and special taxation districts. Ad Solutions to help your business manage the sales tax compliance journey. Before-tax price sale tax rate and final or after-tax price.

If you know the total sales price and the sales tax percentage it will calculate the base price before taxes and. Why A Reverse Sales Tax Calculator is Useful. To easily divide by 100 just move the decimal point two spaces to the left.

Florida Property Tax Calculator. On March 23 2017 the Saskatchewan PST as raised from 5 to 6. Pre Tax Price of Product Sale Price Post Tax Price 1 TAX RATE.

OP with sales tax OP tax rate in decimal form 1. To find the original price of an item you need this formula. Restaurants In Matthews Nc That Deliver.

Sales tax calculator to reverse calculate the sales tax paid and the net price. There are times when you may want to find out the original price of the items youve purchased before tax. Calculate Reverse Sales Tax.

PRETAX PRICE POSTTAX PRICE 1 TAX RATE. Formula s to Calculate Reverse Sales Tax. Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax.

Tax 3799 0075. Now find the tax value by multiplying tax rate by the before tax price. Learn how Avalara can help your business with sales tax compliance today.

Instead of using a reverse Sales Tax Calculator you can divide the final items price by 1 total Sales Tax. Essex Ct Pizza Restaurants. Florida Washington Tennessee and Texas all generate more than 50 percent of their tax revenue from.

Sales TaxPrice Before TaxPrice After Tax025050075010001250. Sales Tax Calculator Reverse Sales Tax Calculator. Tax 319 0075.

Calculate net price and sales tax amounts. 75100 0075 tax rate as a decimal. See the article.

Reverse Sales Tax Computation Formula. Enter the sales tax percentage. Now find the tax value by multiplying tax rate by the before tax price.

Free online 2018 reverse sales tax calculator for Florida. That entry would be 0775 for the percentage. The second script is the reverse of the first.

52 rows This reverse sales tax calculator will calculate your pre-tax price or amount for you. A Reverse Sales Tax Calculator is useful if you itemize your deductions and claim overpaid local and out-of-state sales taxes on your taxes. Firstly divide the tax rate by 100.

To easily divide by 100 just move the decimal point two spaces to the left. Then use this number in the multiplication process. Additionally some counties also collect their own sales taxes of up to 15 which means that actual rates paid in Florida may be as high as 75.

Income Tax Rate Indonesia. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. And Internal Revenue Service Free online 2020 reverse sales tax calculator for Florida The Tax Calculator uses tax information from the tax year 2021 to show you take-home pay.

The only thing to remember about claiming sales tax and tax forms is to save every receipt for every purchase you intend to claim. Instead of using the reverse sales tax calculator you can compute this manually. So if the room costs 169 before tax at a rate of 0055 your hotel.

Real Estate Capital Gains Calculator Internal Revenue Code Simplified

Reverse Sales Tax Calculator 100 Free Calculators Io

How To Pay Sales Tax For Small Business 6 Step Guide Chart

Shopify S Sales Tax Liability And Nexus Dashboard Results Explained Taxvalet

Us Sales Tax Calculator Reverse Sales Dremployee

The Impact Of Hybrid Work On Commuters And Nyc Sales Tax Office Of The New York City Comptroller Brad Lander

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

Cryptocurrency Taxes What To Know For 2021 Money

1031 Exchange Calculator With Answers To 16 Faqs Internal Revenue Code Simplified

Us Sales Tax Calculator Reverse Sales Dremployee

How To Pay Sales Tax For Small Business 6 Step Guide Chart

Real Estate Property Tax Constitutional Tax Collector

Florida Tax Deed Sales Real Estate Attorney Dewitt Law Firm